- Pallet prices should stabilize in 2023, with upward pressure in 2024 and beyond as the economy improves.

- While conditions have improved, pallet providers are weathering input prices overall and are still constrained by staffing shortages.

- Increased current availability has led to watchdogging on prices. Pallet buyers should be mindful of how important trusted supplier relationships were just a year ago and how they will be again as the economy improves or in the case of new disruption.

- The best path forward for pallet buyers is to avoid a cherry-picking approach. Create a trusted relationship with an experienced, expert pallet supplier who can help you develop a pallet strategy for the months and years ahead.

With the economy slowing, the pallet trends for 2023 have turned a page from our 2022 pallet trends report. Last year, supply constraints and robust demand resulted in unprecedented pallet price increases. A year later, with rising interest rates, ongoing inflation, and a weakening economy, the picture is somewhat different. COLA increases are historically high in 2022 into 2023—near double digits. Pallet supply conditions have improved, but due to factors outlined below, they will remain much higher than pre-pandemic levels.

Last year, pallet prices ballooned by 50 to 120 percent, depending on the market segment. The market is softening, and pallet prices are beginning to come down. With pallet suppliers holding higher inventories and improved availability, the pendulum has switched to a buyer’s market. Purchasers are watchdogging pallet prices looking for relief or concessions. This is a tact that pallet purchasers should pursue with caution, as we discuss later in this article. Meanwhile, the continued expansion of private-equity-backed multi-site pallet companies in the pallet space has created greater competitiveness on the national pallet level.

Over the last two years, one factor that has influenced the market has been rental pallet users ordering recycled Grade A and premium pallets to be as close to the rental platform as possible for orders shipping into retail. They have done this in the summer months to supplement their Chep or PECO allocation. This year, a similar summer crunch is not anticipated.

The pallet market is slightly trending downward, but the prognosis is that pallet pricing will never return to pre-COVID numbers. The market has been reset presumably to that inflation balloon or a long-term situation of 1.5 times the price of what it used to be. The white wood pool currently enjoys more plentiful recycled pallets in circulation based on higher levels of new pallet production over the last year. Lead times have improved or shortened. Now it’s 3 to 5 days for recycled pallets and 1 to 2 weeks for new pallets. Recent large RFPs indicate that inventory is returning to many markets.

Modifications are currently being produced to manufacture the 48×40 new GMA pallets that are less in board dimensions. This modification offers a Grade B New pallet in essence.

Pallet Prices

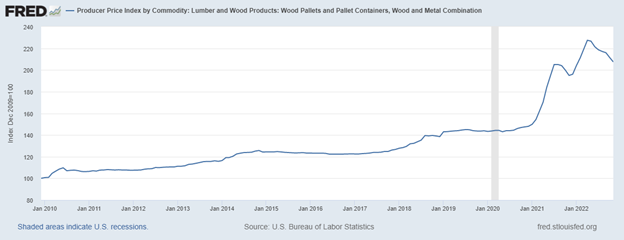

Upward price pressures in the second half of 2021 and throughout 2022 were characterized by unprecedented lumber prices. Prices slightly trended downward at the beginning of 2022 and then continued an upward climb. The yo-yo effect is clear in the charts. Fortunately, the November 2022 FRED Producer Price Index for wood pallets declined to 207.45. The Index, while still considerably high, indicated signs of moderate relief.

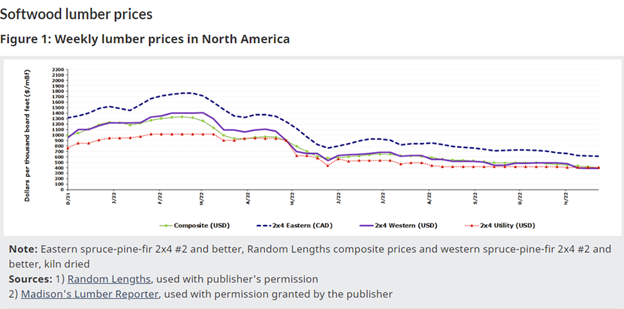

While softwood lumber has continued to soften in pricing throughout the third quarter, hardwood lumber just recently saw a downturn starting in September 2022 for lower pricing. Raw material increases have caused the price of 48x40s, the most dominant shipping platform, to soar. Softwood has come way down and will likely begin to rise again in Q1 of 2023.

Wood pallet prices: Source: https://fred.stlouisfed.org/series/WPU08410101

Source: NRCAN: https://www.nrcan.gc.ca/our-natural-resources/domestic-and-international-markets/current-lumber-pulp-panel-prices/13309

Labor Remains a Key Constraint

The labor issues that came about at the beginning of the COVID era continue to adversely impact global manufacturers. As in other industries, the shrinking labor pool has made it difficult for pallet manufacturers to achieve the staffing levels required to continually meet the pallet demands. This has led to an increase in automated machinery that allows for plants to hire fewer employees. Even as more lumber comes onto the market, some pallet companies are reporting that they do not have the people available to process it.

Increased investment in pallet automation has enabled more women to enter the workforce as heavy lifting declines and productivity rises.

Labor shortages remain a huge issue, along with rising wages being paid to retain employees.

- Increased wage competition from similar low-skilled industries (construction, manufacturing, and warehousing).

- Increased wage competition for entry-level retail jobs, which are typically much less physically demanding.

- Shortage of unskilled labor.

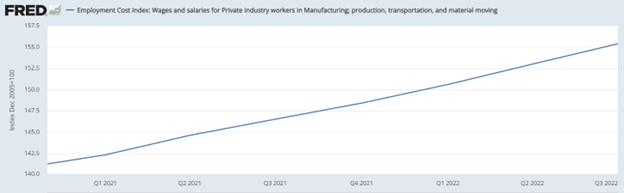

The Employment Cost Index shown below has increased from 148.4 in Q4 of 2021 up to 155.4 in Q3 of 2022. This change represents a 4.72 percent increase in the index. From the beginning of 2020 through Q4 of 2021, the index rose 7.77 percent to put this last year’s increase into perspective.

Current slowdowns in sectors such as construction, manufacturing, and retail may help improve labor availability for the pallet sector. Still, overall, the pallet industry labor outlook is challenging, as pallet jobs are typically demanding compared to alternatives. Higher wages won over the last two years will not retreat, becoming a higher proportion of total pallet cost for the foreseeable future.

Source: https://fred.stlouisfed.org/series/CIU2023000500000I

Materials

As mentioned above, lumber prices and lack of availability have fueled the large pallet price increases over the last few years. As everyone is well aware, the impact of inflation has also crept into almost every cranny and, in this context, materials, and services.

For recycled pallets, repair components are a mix of new and recycled lumber, the higher cost of pallet cores (used pallets) and lumber has had an impact on recycled pallet costs.

Consider the following:

- Sawmills are rebounding in terms of supply but continue to fall behind on cutting and producing lumber to meet demand. Here recent, the wet weather and Canadian mill shutdowns will continue to tighten supply.

- Rising steel costs paired with high international shipping costs have increased substantially. Pallet recyclers need to be aware that available supply and pricing may get worse due to a huge spike in duties (154.33%) for Oman imports. Oman is the world’s largest supplier of nails and fasteners and may shut down due to this spike in duties.

- Excess recycled components are becoming increasingly hard to find in the marketplace because businesses have been forced to reuse pallets rather than returning them as “cores.” This makes for greater competition and fewer recycled materials, which are driving up the price.

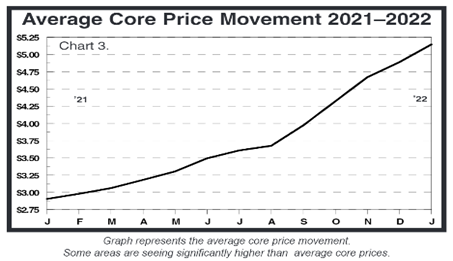

- The pallet core price chart below shows the increases recyclers are having to pay to secure recycled components to be able to repair other pallets without using new lumber. This increase in pallet core pricing below covers any odd size or scrap material that might be used to cut and splice broken deck boards as well.

- Core pallet prices continue to increase and sit over the $6.00 mark on the national average. This increase is well over double in looking back just one year.

Pallet Core Prices

Source: http://palletprofile.com/pallet/index.asp

Transportation

Transportation plays an important role in the pallet industry, both for inbound lumber and nail deliveries, as well as for outbound pallet delivery. Pallets, when assembled, have not had a high-value density. As such, they have been uneconomical to ship across considerable distances. The rule of thumb has been generally around 200 miles. As pallet prices increased in 2022, we found opportunities to ship pallets farther to customers. As we show below, however, transportation constraints remain a concern.

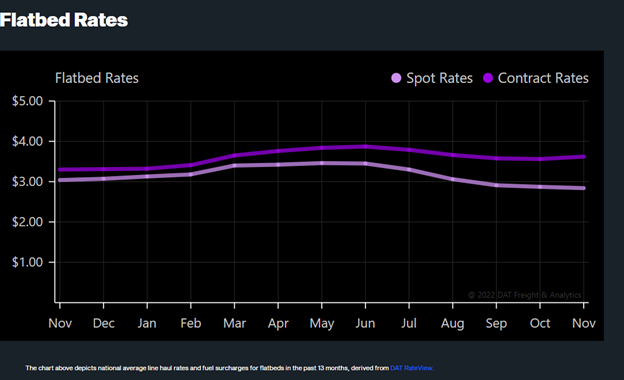

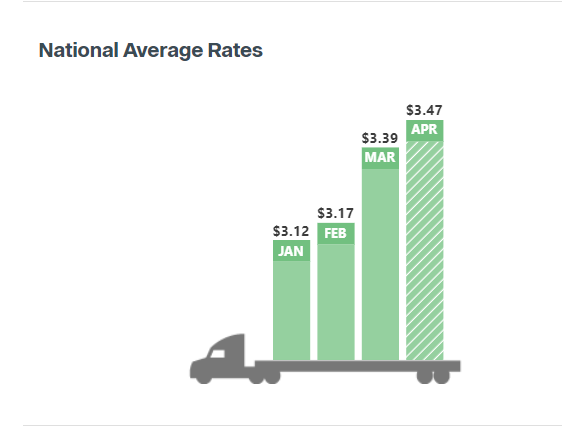

Flatbed spot rates continued to set records in 2022. According to DAT Trendlines, flatbed spot rates hit an all-time high in June 2022, as shown immediately below. The National Average Rates chart demonstrates a decline for November 2022 to $2.84 for Spot Rates compared to $3.62 on Contract Rates. Experts predict a softening in rates for Q1 2023.

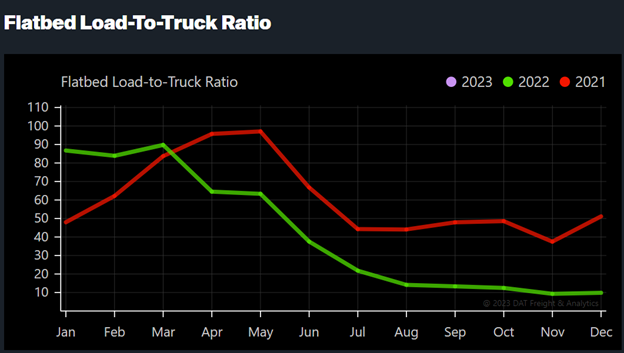

Flatbed Load-to-Truck Ratio

Flatbed Rates

Source: https://www.dat.com/industry-trends/trendlines/flatbed/national-rates

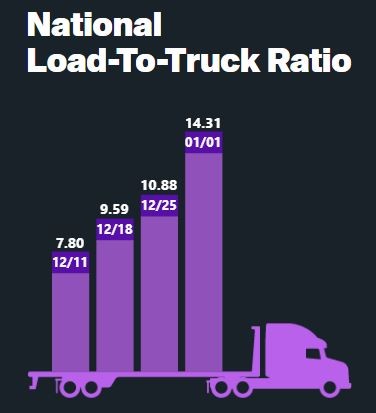

Load-to-Truck Ratio

Load-to-truck ratios represent the number of loads posted for every truck on DAT Load Boards. The flatbed load-to-truck ratio remained extremely high during the beginning of 2022, sitting at 86.75 in January. However, as we moved into the end of Q2 2022, we began to see the flatbed load-to-truck ratio fall and keep falling for the remainder of 2022. As of October 2022, the load-to-truck ratio sat at 12.45 loads per flatbed posted. Competition drives up the prices that shippers must pay. The load-to-truck ratio has seen relief since Q2 2021 as an infusion of independent carriers has helped the stabilization of freight costs. As of early January 2023, we are seeing load-to-truck ratios get close to 14 loads per truck (see the second image below).

Flatbed Load-to-Truck Ratio

Flatbed Load-to-Truck https://www.dat.com/trendlines/flatbed/demand-and-capacity

CASS Linehaul Index

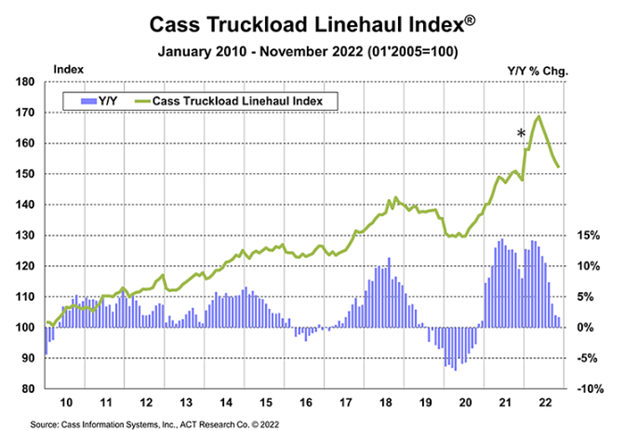

The Cass Truckload Linehaul Index® is a measure of market fluctuations in per-mile truckload linehaul rates, independent of additional cost components such as fuel and accessory charges. The CASS Linehaul Index currently sits at 152.1 through November 2022. This is a 1.7 percent year-over-year increase compared to November ’21 and an 11.4 percent two-year stacked change.

CASS Linehaul Index

Source: https://www.cassinfo.com/freight-audit-payment/cass-transportation-indexes/truckload-linehaul-index

Fuel

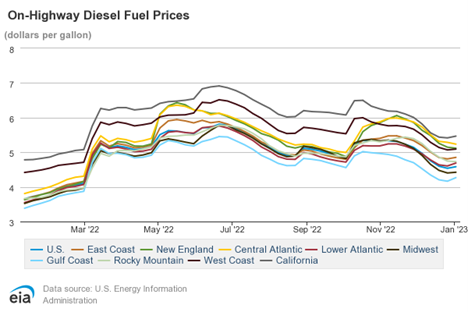

The average price for diesel fuel has tapered off slightly but remains at the ballooned inflation market highs. As of January 2023, the average diesel price was down to $4.58, up $0.97 since January 2022. The chart below shows diesel prices over the last twelve months.

Source: https://www.eia.gov/petroleum/gasdiesel/

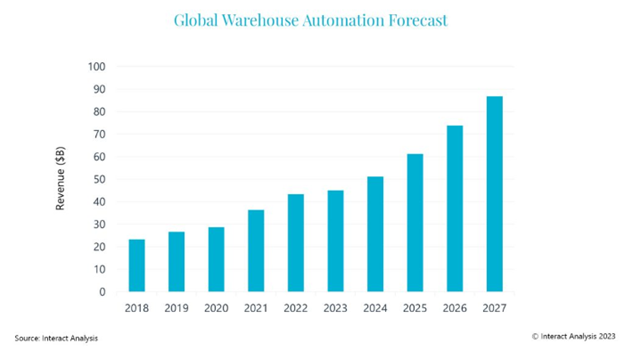

With the US Fed increasing interest rates to control inflation, pumping the brakes on the economy should have a stabilizing effect on pallet prices, and reduced consumer demand will help. We are already seeing this in the marketplace as availability increases and some price concessions are being made. Keep in mind, however, that the economy is expected to improve in 2024. The Conference Board forecast that 2022 Real GDP growth will come in at 1.9 percent year-over-year, 2023 growth will slow to zero percent year-over-year, and 2024 growth will rebound to 1.7 percent year-over-year. Other product categories, such as warehouse automation investment, are expected to continue a growth trajectory after a flat 2023.

As seen in the discussion above, input prices for pallets remain high. While lumber supply has stabilized, albeit at higher than pre-COVID levels, other inputs such as labor, nails, cores, and transportation, not to mention higher interest rates, continue to put upward pressure on pallet prices.

At the same time, pallet recyclers, particularly smaller ones or others who are not locked into higher core price agreements, might be in a position to offer better prices. Given the supply chain lessons of recent years, however, pallet buyers must keep in mind any potential risk to their operation regarding reliability of inconsistent supply and quality failure.

Also, buyers should avoid damaging supplier relationships by aggressive price shopping and changing suppliers in the current economy. As the economy improves through 2024 and beyond, the loss of trusted relationships might be far more costly in the long run than incremental savings in the current market. And, of course, there is the issue of disruption. How resilient is your supplier?

While the pallet market has taken a breather, for the moment, its dynamics remain very much in flux. A strong partnership, based on trust, with an experienced, expert pallet provider can help you successfully navigate these waters. To find out how we can help you better map out your pallet strategy in the months and years ahead, contact First Alliance Logistics Management.