Remember those pre-COVID days, when creating the budget for the next year’s pallet expenditure was a simple cut and paste? For years, pallet prices remained relatively flat, with producers generally struggling to pass on much in the way of price increases. There was just too much industry capacity, and too many competitors, as pallet producers were known to lament.

In 2021, however, as most everyone is now aware, North American supply chains were rocked by unexpected and unprecedented price increases to both new wood pallets as well as recycled pallets. COVID-19 impacts were blamed for much of the disruption. Initially, lumber supply was constrained due to COVID-related closures, and then demand surged on the strength of home building and DIY activity. The lumber situation was further compounded by labor shortages, freight challenges, increased tariffs on Canadian softwood lumber, forest fires, floods and more.

As new pallet availability slowed and rental pallet supply was disrupted, interest in recycled pallets heightened. Pallet users tended to hang onto used pallets longer, further exasperating supply. Any hopes for the pallet market to trend downward to pre-COVID pricing levels have proven groundless, and will be unlikely to come to fruition, as we outline below.

Pallet Prices

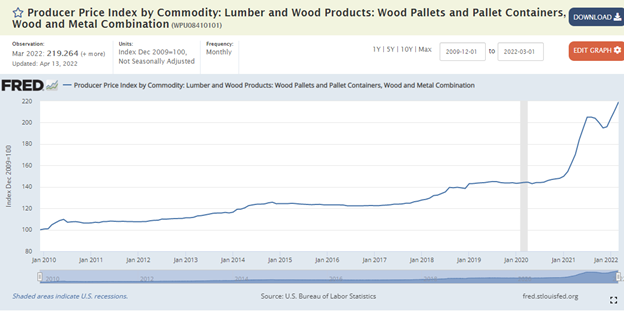

Upward price pressures in the second half of 2021 took a brief breather in the final quarter, with prices trending downward in November before moving upward once again. To March 1, 2022, the FRED Producer Price Index for wood pallets was a record high 219.26. The Index shows an increase of over 68% from January 2021 to March 2022.

Source: https://fred.stlouisfed.org/series/WPU08410101

Labor Remains a Key Constraint

The labor issues that presented at the beginning of the COVID era continue to be a drag on capacity improvements that would help availability. Even as more lumber comes onto the market, some pallet companies are reporting that they do not have the people available to process it.

The Recycle Record is still reporting that 95% to 100% of plant capacity is being used. The market is hot! The lack of available capacity in the market makes it potentially precarious to move on from one pallet vendor to another.

Labor shortages remain a huge issue along with rising wages being paid to retain employees.

- Increased wage competition from similar low skilled industries (construction, manufacturing, and warehousing).

- Increased wage competition for entry-level retail jobs, which are typically much less physically demanding.

- Shortage of unskilled labor.

The Employment Cost Index shown below has increased from 142.3 in Q1 of 2021 up to 148.4 in Q4 of 2021. This change represents a 4.3% increase in index. From the beginning of 2019 through Q4 of 2020 the index rose 5.6% to put this last year’s increase into perspective.

Source: https://fred.stlouisfed.org/series/CIU2023000500000I

Materials

As mentioned above, lumber prices and availability have fanned the flames of pallet price increases. And beyond that, the impact of inflation is being felt across the board regarding materials and services.

While softwood lumber is showing signs of softening in the second quarter, hardwood lumber pricing has increased steadily in 2022 with prices up over 40% YTD. For recycled pallets, while repair components are a mix of new and recycled lumber, the higher cost of pallet cores (used pallets) and lumber have an impact on recycled pallet costs. Raw material increases have caused the price of 48×40’s, the most dominant shipping platform, to soar.

Consider the following:

- Sawmills are rebounding but continue to fall behind on cutting and producing lumber while demand is soaring. Domestic hardwood lumber prices have increased by over 40% compared to last year.

- Rising steel costs paired with high international shipping costs has doubled and in some cases, tripled the landed price of nails compared to last year.

- Excess recycled components are becoming increasingly hard to find in the marketplace because businesses have been forced to reuse pallets rather than returning them as “cores.” This makes for greater competition and less recycled materials which are driving up the price.

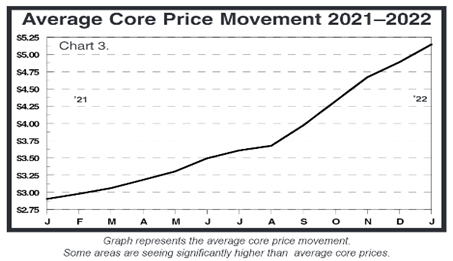

- The pallet core price chart below shows the increases recyclers are having to pay to secure recycled components in order to be able to repair other pallets without using new lumber. This increase in pallet core pricing below covers any odd size or scrap material that might be used to cut and splice broken deck boards as well.

- Core pallet prices have increased 81% from February ’21 to February ’22 where prices have increased from $2.85 up to $5.15.

Pallet Core Prices

Source: http://palletprofile.com/pallet/index.asp

Transportation

Transportation plays an important role in the pallet industry, both for inbound lumber and nail deliveries, as well as outbound pallet delivery. Pallets, when assembled, have not had a high value density, and as such, have been uneconomical to ship considerable distance. The rule of thumb has been generally around 200 miles. However, as pallet prices increase, we are increasingly seeing opportunities to ship pallets further distances to customers. As we show below, however, transportation constraints remain a source of concern.

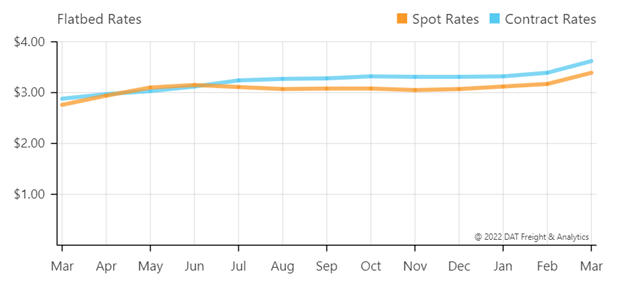

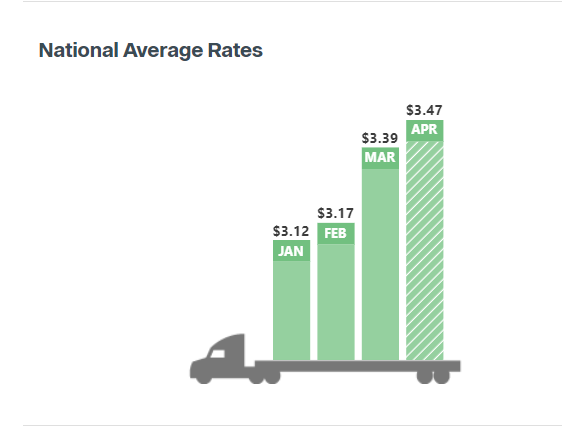

Flatbed spot rates continue to set records in 2022. According to DAT Trendlines, flatbed spot rates just hit an all-time high at $3.39 per mile in March, as shown immediately below. The National Average Rates chart predicts that as of April 2022 will end up at $3.47 per mile for flatbeds, as seen in the second image from DAT, shown in the second chart below.

National Flatbed Rates

Source: https://www.dat.com/industry-trends/trendlines/flatbed/national-rates

Load-to-Truck Ratio

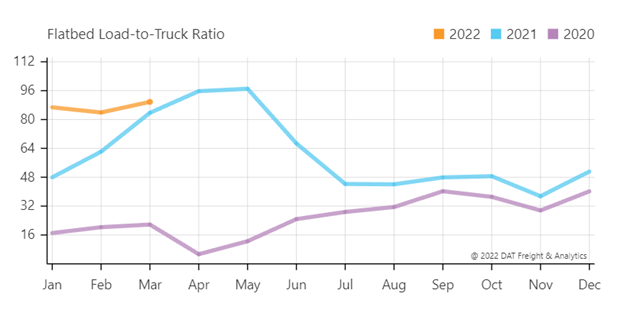

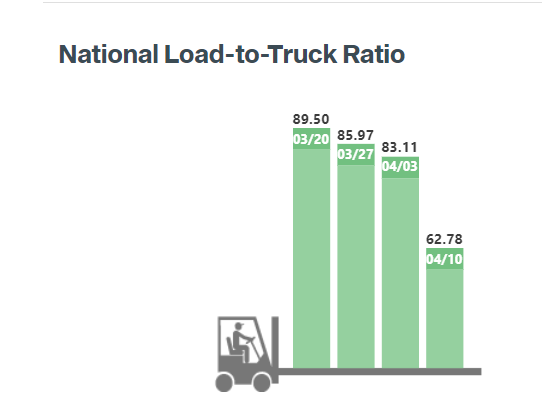

Load-to-truck ratios represent the number of loads posted for every truck posted on DAT Load Boards. The flatbed Load-to-Truck ratio began to climb again in the last quarter of 2021 and has jumped tremendously in 2022. As of March, the Load-to-truck ratio sat at 89.77 loads per flatbed posted. (See image immediately below.P Competition drives up the prices that shippers must pay. Good news, however, is that the Load-to-Truck ratio has dropped significantly in April (second image below) which augurs well for stabilization of freight costs.

Flatbed Load-to-Truck Ratio

Flatbed Load-to-Truck https://www.dat.com/trendlines/flatbed/demand-and-capacity

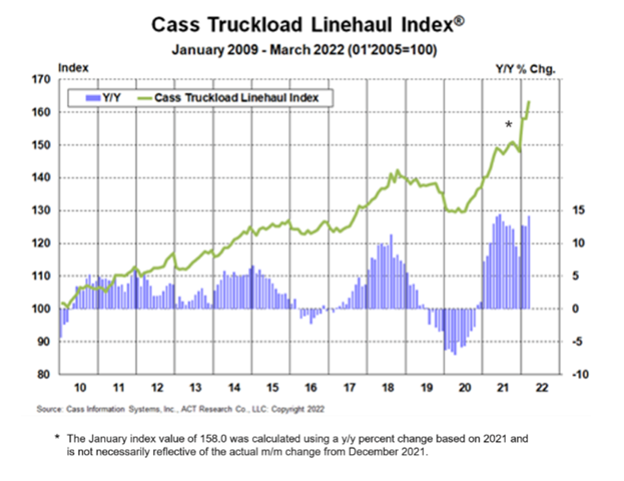

CASS Linehaul Index

The Cass Truckload Linehaul Index® is a measure of market fluctuations in per-mile truckload linehaul rates, independent of additional cost components such as fuel and accessory charges. The CASS Linehaul Index has just set another record high in March 2022 at 163.4 points, a year-over-year increase of 14.2%.

CASS Linehaul Index

Source: https://www.cassinfo.com/freight-audit-payment/cass-transportation-indexes/truckload-linehaul-index

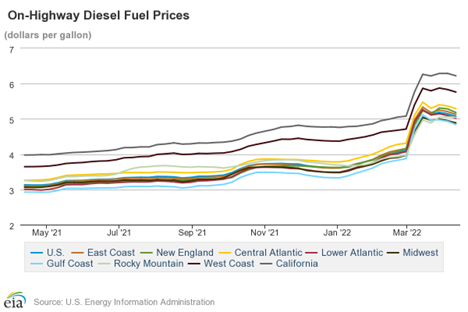

Fuel

The average price for diesel fuel has steadily climbed throughout the year. As of April 11, the average price for diesel was $5.07 per gallon, up $1.94 or almost 62% from a year earlier. The chart below shows diesel prices over the last twelve months.

Source: https://www.eia.gov/petroleum/gasdiesel/

As can be seen in the discussion above, input prices for pallets have increased across the board, from lumber, pallet cores and nail prices, to labor and transportation and other items as well.

These inputs remain at play that will help shape pallet supply in the months and years ahead. Some prognosticators are predicting a return to “normalcy” later this year or next year. Reduced demand will help. With the US Fed eyeing increased interest rates to control inflation, pumping the brakes on the economy should have a stabilizing effect on pallet prices. To find out how we can help you better map out your pallet strategy in the months and years ahead, contact First Alliance Logistics Management.