With the economy slowing, the pallet price trends for 2023 have turned a page from the 2022 pallet price trends report. Last year, supply constraints and robust demand resulted in unprecedented pallet price increases. A year later, with rising interest rates, ongoing inflation, and a weakening economy, the picture is somewhat different. COLA increases are historically high. Pallet supply conditions have improved, but due to factors outlined below, they will remain higher than pre-pandemic levels.

Last year, pallet prices ballooned by 50 to 120 percent, depending on the market segment. The market has softened. With pallet suppliers holding higher inventories and improved availability, the pendulum has switched to a buyer’s market. Purchasers are watchdogging pallet prices looking for relief or concessions. This is a tact that pallet purchasers should pursue with caution, as we discuss later in this article. Meanwhile, the continued expansion of private-equity-backed multi-site pallet companies in the pallet space has created greater national competitiveness.

Over the last two years, one factor that influenced the market was a rental pallet shortage that pushed desperate customers into the pallet purchasing arena. That situation temporarily exacerbated the pallet shortage, but has now been corrected. The white wood pool currently enjoys more plentiful recycled pallets in circulation based on higher levels of new pallet production during the COVID-19 bump and increased empty pallet availability as supply chains have reduced their “just-in-case” safety stock levels.

Pallet Prices

Upward price pressures in the first quarter of 2022 were characterized by unprecedented lumber prices still. Beginning in May of 2022 we finally started to see some relief in pallet prices for the first time since October 2021. We have continued to see a steady decline in pallet prices since then, which is due in large part to the cost of lumber going down as well as the cost of transporting the lumber being significantly reduced. As of April 2023, FRED Producer Price Index for wood pallets declined to 198.82, the lowest it has been since June of 2021. The Index, while still considerably high, indicated signs of moderate relief.

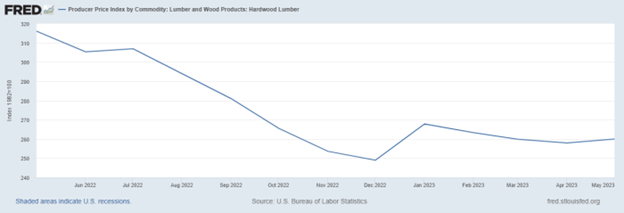

In 2022, we saw softwood lumber get gradually lower in price as the year went on. However, since the end of Q3 in 2022, softwood has remained very constant in its pricing which can be a good sign as it means prices are holding steady, at least for the time being. Hardwood material, on the other hand did not see as many reductions in price during 2022. This led to recyclers making more robust softwood pallets to provide a cheaper pallet than the same hardwood pallet, while still being able to hold the same weight. Starting in the Q1 of 2023, we finally started to see the hardwood prices softening, and have continued to see this trend into Q3 of 2023.

This has led to an increase in raw materials in both softwood and hardwood for manufacturers which leads to a reduction in pallet prices as there are more pallets being built and put into the market. Raw materials becoming much cheaper all around has led to a consumers’ market where they have the freedom of choosing who to work with since all prices have evened out and everyone has availability.

Wood pallet prices

Wood pallet prices: Source: https://fred.stlouisfed.org/series/WPU08410101

Softwood lumber prices

Source: NRCAN: https://www.nrcan.gc.ca/our-natural-resources/domestic-and-international-markets/current-lumber-pulp-panel-prices/13309

Hardwood lumber prices

Source: https://fred.stlouisfed.org/series/WPU0812#

Labor Remains a Key Constraint

The labor issues that came about at the beginning of the COVID era are still present and continue to adversely impact global manufacturers. As seen in other industries, the labor pool continues to shrink and as a result, has made it difficult for pallet manufacturers to achieve the staffing requirements needed to meet the pallet demands of 2023. This has led to an increased use of automated machinery that allows manufacturers to mirror the same productivity as before, but with a smaller workforce. Even as more lumber comes onto the market, some pallet companies are reporting that they do not have the people available to process it and are ultimately losing opportunities to expand and grow.

Increased investment in pallet automation has enabled more women to enter the workforce as heavy lifting declines and productivity rises.

Labor shortages remain a huge issue into 2023, along with rising wages being paid to retain employees.

- Increased wage competition from similar low-skilled industries (construction, manufacturing, and warehousing).

- Increased wage competition for entry-level retail jobs, which are typically much less physically demanding.

- Shortage of unskilled labor.

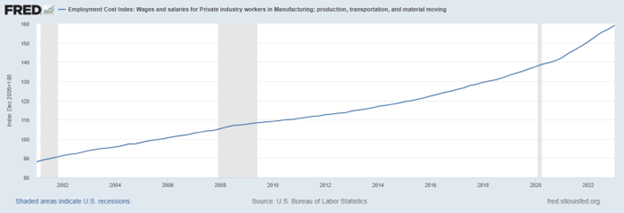

The Employment Cost Index shown below has increased from 150.6 in Q1 of 2022 up to 159.1 in Q1 of 2023. This change represents a 8.5 percent increase in the index. From the beginning of Q1 in 2021 through Q1 of 2022, the index rose 8.3 percent to put this last year’s increase into perspective.

Current slowdowns in various sectors such as construction, manufacturing, and retail may help improve labor availability for the pallet sector. However, the outlook on the pallet industry labor as a whole still remains to be a challenge, as pallet jobs are typically demanding compared to alternatives. Higher wages won over the last few years, persist, becoming a higher proportion of total pallet cost as we carry on with the rest of 2023.

Wages and salaries

Source: https://fred.stlouisfed.org/series/CIU2023000500000I

Materials

Halfway through 2023, lumber prices have come down. Being the most expensive input into the cost of a pallet, those lower prices have led to a degree of price relief. As everyone is aware, the impact of inflation is still a concern for what costs will look like down the road.

For recycled pallets, repair components are a mix of new and recycled lumber. As the cost of pallet cores (used pallets) and lumber has been lowering, it has had an impact on recycled pallet costs and has resulted in excess availability in inventory among suppliers.

Consider the following:

- Excess recycled components are becoming increasingly abundant in the marketplace.

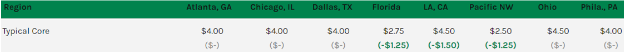

- Core pallet prices continue to decrease and sit right at the $4.50 mark on the national average. This decrease is under $2.00 per in some areas, from $6.00 in 2022.

Pallet Core Prices

Transportation

Transportation plays an important role in the pallet industry, both for inbound lumber and nail deliveries, as well as for outbound pallet delivery. Pallets, when assembled, do not have a high-value density. As such, they have been uneconomical to ship across considerable distances. The rule of thumb has been generally around 200 miles or less. As pallet prices and cost of fuel have decreased in 2023, we found opportunities to ship pallets farther to customers. As we show below, transportation costs have seen a gradual decline.

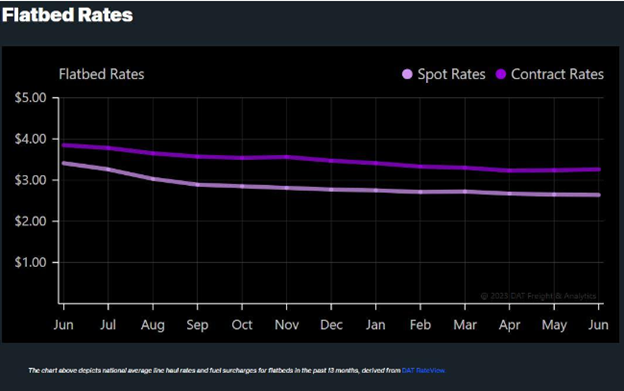

Flatbed spot rates have decreased in 2023. According to DAT Trendlines, flatbed spot rates have gradually decreased since reaching an all-time in June 2022, as shown immediately below.

Flatbed Rates

Source: https://www.dat.com/industry-trends/trendlines/flatbed/national-rates

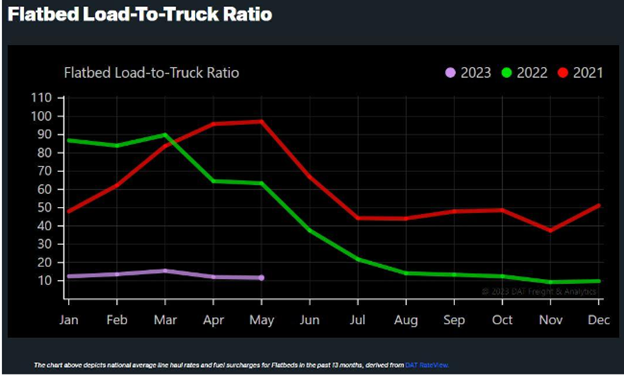

Load-to-Truck Ratio

Load-to-truck ratios represent the number of loads posted for every truck on DAT Load Boards. The flatbed load-to-truck ratio has dropped tremendously in the past 12 months, currently sitting at 12.47 in January of 2023 as opposed to 86.75 in January of 2022. However, as we moved more into Q1 of 2023, we began to see the flatbed load-to-truck ratio rise to a high of 15.47 in March. Competition drives up the prices that shippers must pay, so when there are very few loads per truck, the shipper can regain control of the markets and have a greater influence on how much lanes will cost. Based on current forecasts, the load-to-truck ratio should not go back to 2022 levels and should remain close to 10-15 loads per truck or less for a vast majority of 2023.

Flatbed Load-to-Truck Ratio

Flatbed Load-to-Truck https://www.dat.com/trendlines/flatbed/demand-and-capacity

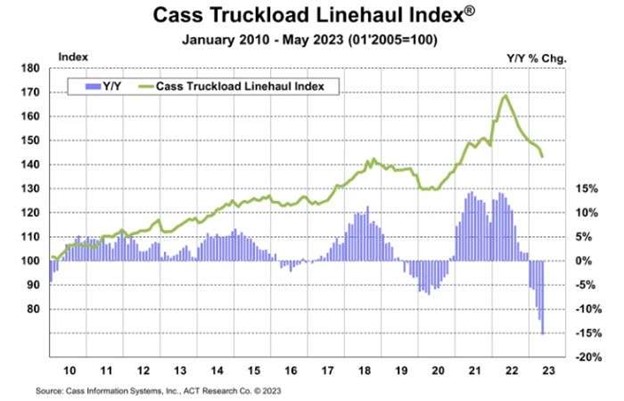

CASS Linehaul Index

The Cass Truckload Linehaul Index® is a measure of market fluctuations in per-mile truckload linehaul rates, independent of additional cost components such as fuel and accessory charges. The CASS Linehaul Index currently sits at 146.6 through April 2023. This is a 12.3 percent year-over-year decrease compared to April ’22 and an 0.1 percent increase in terms of a two-year stacked change.

Source: https://www.cassinfo.com/freight-audit-payment/cass-transportation-indexes/truckload-linehaul-index

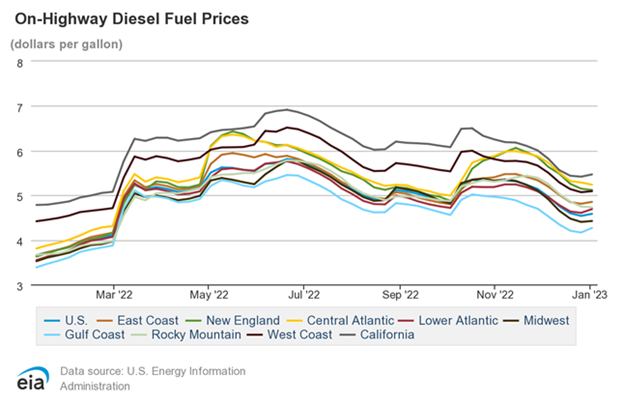

Fuel

The average price for diesel fuel has started to decrease but remains at the ballooned inflation market highs. As of May 2023, the average diesel price was down to $3.88, down $1.68 since May 2022. The chart below shows diesel prices over the last twelve months.

Source: https://www.eia.gov/petroleum/gasdiesel/

Navigating the Pallet Price Trends

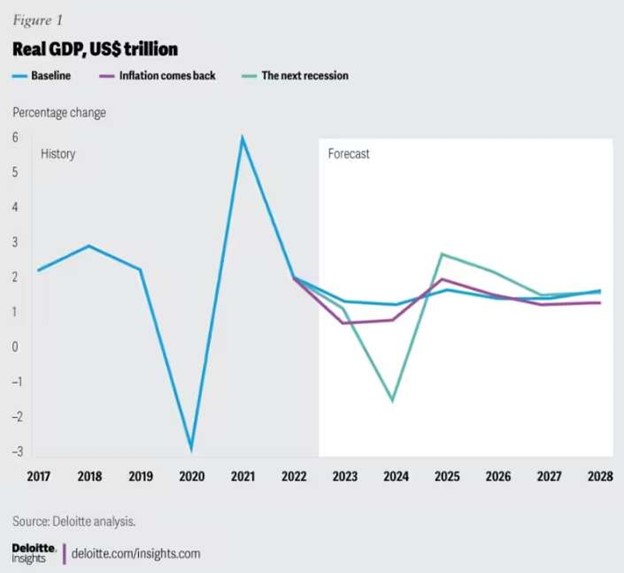

Big picture, Deloitte forecasts the economy as slowing substantially in the second half of 2023. As a result, demand for pallets can also be expected to reflect this trend. Deloitte models GDP impact under three alternative scenarios, including Baseline (60% probability), Inflation (20%) and Recession (20%).

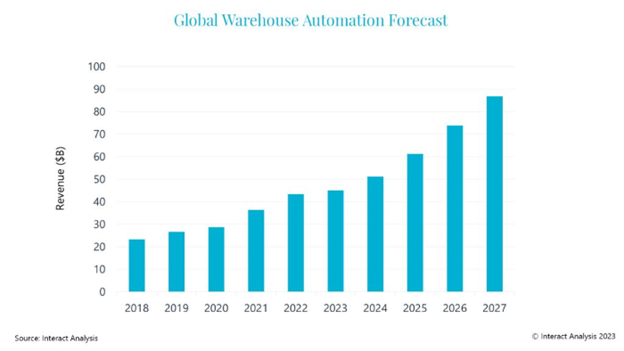

Other related product categories, such as warehouse automation investment, are expected to continue a growth trajectory after a flat 2023, which will positively influence pallet markets in coming years. In a June 15, 2023 release, automation provider Interroll reported that “it has become apparent that there have been further postponements of end-customer projects, resulting in a delayed reduction of inventories. In addition, there is a general economic slowdown specifically in EMEA, while a recovery in Asia-Pacific is slow and delayed. The Americas region continues to develop positively.” This continued investment in U.S. supply chain infrastructure speaks to a belief that the economy will rebound, and that labor will continue to be a constraint in the years ahead.

As seen in the discussion above, pallet prices have softened but remain high. Lumber and transportation availability and pricing have improved, although labor availability remains a significant constraint for many pallet suppliers and will add pressure to increase wages as demand rebounds.

Like the economy, the pallet market has taken a breather, for the moment. Buyers have options, but typically not the bandwidth to thoroughly vet them. A strong partnership, based on trust, with an experienced, expert pallet provider can help you successfully navigate these waters. To find out how we can help you better map out your pallet strategy in the months and years ahead, contact First Alliance Logistics Management.